Idaho

Trust-based Planning

Manage and distribute your assets according to your wishes, ensuring a seamless transfer of wealth.

Trust-based planning is a strategic tool for avoiding probate. In a properly funded trust, the assets in the trust are managed and distributed according to the trust’s established instructions. Idaho Estate Planning guides Idaho families in designing a trust specific to their family. Let attorneys Mark E. Wight or Carly Ward share their experience to design your family’s trust. Our guidance includes preparing, interpreting, executing, and distributing the trust according to its established guidelines

Designing your Trust in Idaho

Thousands of families in the Treasure Valley and throughout Idaho have entrusted attorneys Mark E. Wight and Carly Ward with creating customized trusts, also known as Legal Life Plans™. Each plan ensures a seamless transfer of assets to their loved ones. With Idaho Estate Planning’s legal direction, you can rest assured that your trust is created and will be managed with precision and care.

Our services include:

- Designing a custom trust based plan to accomplish your wishes including the following documents:

- Trusts (revocable and irrevocable)

- Pour over wills

- Financial Powers of Attorney

- HIPAA

- Health Care Power of Attorney

- Advanced Health Care Directives

- Help you move property into the trust

- Assist with the funding process

- Review your trust annually with our Life Plan Protector Program™

Your trust is as individual as your life’s journey. With Idaho Estate Planning by your side, you’re not just setting up a system; you’re laying down a path that ensures your intentions are fulfilled, your loved ones are cared for, and your legacy continues to thrive.

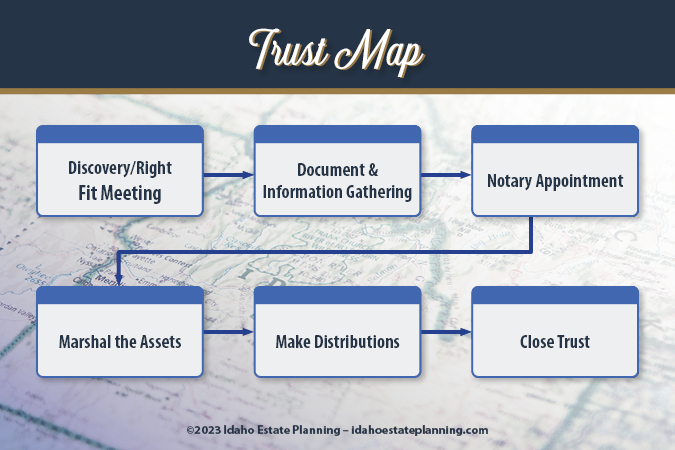

Idaho Estate Planning’s Trust Process

Frequently Asked Questions

What are the benefits of trust administration in Idaho?

Trust administration offers essential benefits, such as preserving privacy, bypassing probate, and ensuring a smooth asset distribution process. When you opt for Idaho Estate Planning’s trust administration services, our skilled estate planning professionals expertly navigate the intricate landscape of probate laws, resulting in time and cost savings.

What is a trust?

A trust serves as a legal instrument that provides instructions for managing your affairs at your death. It also remains valid throughout your lifetime, including times of incapacity. This legal tool controls the utilization, maintenance, and distribution of assets. Trusts offer many advantages, including privacy, potentially avoiding probate, safeguarding beneficiaries, preserving benefits, protecting assets from remarriages, and various financial benefits.

Who should have a trust?

Trusts are a valuable tool for a wide range of individuals and couples. They can be particularly beneficial if you own a house or property, possess substantial assets, have children (whether they’re adults or minors), are part of a blended family, seek tax advantages, value asset and beneficiary protection, prioritize privacy, wish to avoid the probate process, and have specific desires regarding the allocation of your assets.

What is the difference between a Will and a Trust?

Wills and trusts are two legal tools with distinct purposes.

A will serves as a legal document detailing the desired allocation of an individual’s assets at time of death. A Will is effective at time of will makers death. It typically requires the probate process. The probate process is known for its time-consuming, expensive, and court-supervised nature, adding stress to your loved ones during an already challenging time. It can be avoided with proper planning.

In contrast, a trust is a legal arrangement where a trustee oversees and manages assets on behalf of beneficiaries. Unlike a will, a trust is in effect during the trust maker’s lifetime, in times of incapacitation, and at death. A trust offers asset management, privacy, and the potential to avoid probate. Moreover, trusts have the advantage of flexibility in asset distribution, and provides safeguards against challenges and claims.

Are there different types of trusts?

Yes. Many different trust options exist, each with distinct benefits and specific applications. These include but not limited to

- Revocable living trusts

- Irrevocable trusts

- Testamentary trusts

- Special needs trusts

- Medicaid asset protection trusts

- Veteran’s asset protection trusts

- Miller Trusts

- and many others

Each trust type is designed to serve a unique purpose in a solid estate plan, whether it’s optimizing asset protection, tax planning, or protecting a vulnerable individual.

To determine the ideal trust for your family’s unique situation, it’s essential to consult with an experienced estate planning attorney.

Do I need an estate planning attorney to complete my trust?

It is not a legal mandate to hire an estate planning attorney for the creation of your Idaho trust. There are many advantages to working with a seasoned legal professional to complete trust documents and plans.

A seasoned estate planning attorney possesses specialized knowledge of Idaho’s trust laws. A seasoned attorney can ensure the validity and compliance of your trust, and help you sidestep expensive errors and potential pitfalls. Keeping your trust up to date and in good standing is another benefit, allowing you to adapt to life’s changing circumstances and changes in the law.

Lastly, having an attorney by your side provides access to legal advice and, importantly, peace of mind, knowing your trust is meticulously crafted and legally sound.

How often should I review my trust?

Keeping your trust up to date is a wise move, especially when significant life events come your way. Life events can change your wishes, such as:

- marriage,

- divorce,

- re-marriage,

- major health diagnosis,

- welcoming a new addition to the family; and

- acquiring new assets, including businesses.

To maintain the relevance of your Idaho trust, it’s recommended to conduct a thorough review at least every three years. Once a year is optimal.

At Idaho Estate Planning, we go the extra mile for our trust clients with our exclusive Legal Life Plan Protector Program™️. This proprietary program delivers an additional layer of protection for families through an in-depth yearly review, ensuring your trust remains finely tuned to meet your evolving needs.

If I have a trust from one state and move to another state, should I have my trust reinstated in my new state?

It’s crucial to recognize that each state in the U.S. has its unique estate planning and trust laws. A trust is executed under the laws of the state where it is currently situated, regardless of the trust creator’s residence in a different state. Certain states offer more favorable trust benefits, including estate tax reduction (or elimination), making it essential to explore your options.

What is an irrevocable trust?

An irrevocable trust is a type of trust in which the person creating the trust, known as the trust maker or trust maker, transfers assets and property to the trust, relinquishing their ownership and control over those assets. Once this transfer is made, the trust maker typically cannot make changes to or revoke the trust.

Irrevocable trusts serve various purposes, including:

- Asset Protection: Irrevocable trusts can shield assets from creditors, legal claims, and certain types of taxation.

- Estate Tax Reduction: Assets placed in an irrevocable trust may be excluded from the trust maker’s taxable estate, potentially reducing estate tax liability.

- Medicaid Planning: Irrevocable trusts can help individuals qualify for Medicaid benefits by removing assets from their countable assets.

- Charitable Giving: Charitable remainder trusts and charitable lead trusts are forms of irrevocable trusts designed for philanthropic purposes.

- Avoiding Probate: Assets held in an irrevocable trust typically avoid probate, ensuring a smoother and more private transfer of assets to beneficiaries.

It’s essential to understand that once assets are placed into an irrevocable trust, they generally cannot be taken back or altered without adhering to specific legal processes. Therefore, the decision to create an irrevocable trust should be made with the guidance of an experienced estate planning attorney, as it has long-lasting implications on your financial and estate planning strategies.

What is a revocable trust?

A revocable trust, also known as a living trust, is a legal arrangement in which an individual, known as the trust maker or grantor, transfers their assets and property into a trust while retaining the ability to make changes, during their lifetime. This type of trust offers flexibility and control to the trust maker over the trust assets.

Characteristics of a revocable trust include:

- Flexibility: The trust maker can make changes to the trust.

- Avoiding Probate: Assets held in a revocable trust typically bypass the probate process.

- Privacy: Revocable trusts are generally not part of the public record, providing a higher level of privacy.

- Incapacity Planning: Revocable trusts include provisions for managing the trust’s assets in case the trust maker becomes incapacitated or unable to handle their affairs. A revocable trust can help avoid the need for a court-appointed conservator and guardian to manage the trust maker and their assets.

It’s important to note, revocable trusts do not provide the same level of asset protection as other tools. However, revocable trusts are a valuable estate planning tool for managing and distributing assets efficiently at incapacity or death, while maintaining flexibility and control during the trust maker’s lifetime.

What is a testamentary trust?

A testamentary trust is a type of trust that is created within a last will and testament. Unlike revocable and irrevocable trusts, which are established during a person’s lifetime, a testamentary trust is executed upon the death of the individual who created the trust (trust maker).

Characteristics of a testamentary trust:

- Creation in a Will: The provisions for a testamentary trust are outlined in the trust maker’s will. The will specifies the terms, conditions, and instructions for how the trust should be formed and how its assets should be managed and distributed.

- Takes Effect at Death: The testamentary trust does not exist while the trust maker is alive; it is created only upon the trust maker’s death. At that point, the will is probated, and the trust becomes active.

- Asset Management and Distribution: The testamentary trust is designed to manage and distribute specific assets or property as directed by the trust maker. This may involve providing for the financial needs of beneficiaries, such as minor children or individuals with special needs.

- Control Over Assets: The trust maker retains full control over their assets during their lifetime, and the trust’s terms can be modified or revoked until their death.

- Probate Process: Probate is required to execute the terms of the testamentary trust, which means the will and trust provisions become part of the public record.

Testamentary trusts are often used in estate planning to address specific circumstances, such as providing for minor children, and ensuring the care of individuals with disabilities. It is essential to work with an attorney when creating a testamentary trust to ensure your wishes are accurately and legally documented.

What is a special needs trust?

The primary purpose of a special needs trust is to enhance the quality of life for the person with special needs without disqualifying them from essential government benefits such as Medicaid and Supplemental Security Income (SSI).

Characteristics of a special needs trust include:

- Beneficiary: The person for whom the trust is established, typically an individual with a disability or special needs.

- Third-Party or Self-Settled: Parents or other family members often create third-party trusts to provide for the beneficiary, while self-settled trusts are funded with the beneficiary’s assets, such as an inheritance or a personal injury settlement.

- Preservation of Benefits: The trust is structured in a way that the trust’s assets do not count against the beneficiary when determining their eligibility for programs like Medicaid or SSI.

- Discretionary Distributions: The trustee has the discretion to make distributions that can cover various expenses not covered by government benefits. These expenses can include education, therapy, transportation, recreation, and more.

- Trustee: The individual or entity appointed to manage and administer the trust in the best interests of the beneficiary.

The specific rules and regulations governing special needs trusts may vary by jurisdiction, so it’s essential to work with an experienced attorney who specializes in this area to create a trust that complies with the law and meets the unique needs of the beneficiary.

What is a Miller's Trust?

A Miller Trust, also known as a Qualified Income Trust (QIT), is a specialized trust. It is used to help individuals who need long-term care services but have income that exceeds the Medicaid eligibility limits for income.

If this is a tool that is of interest to you, call us at 208-939-7658 or email info@idahoestateplanning.com.